Table of Content

- When to Claim Home Improvement Deductions on Your Taxes

- How to File Your Own Taxes: A Step-By-Step Guide

- Can I Deduct Home Repairs From a Hail Storm on My Taxes?

- Get Tax Credits for the Way You Generate Energy

- Home repairs are not deductible but home improvements are. It pays to know the difference.

- What home repairs are tax-deductible?

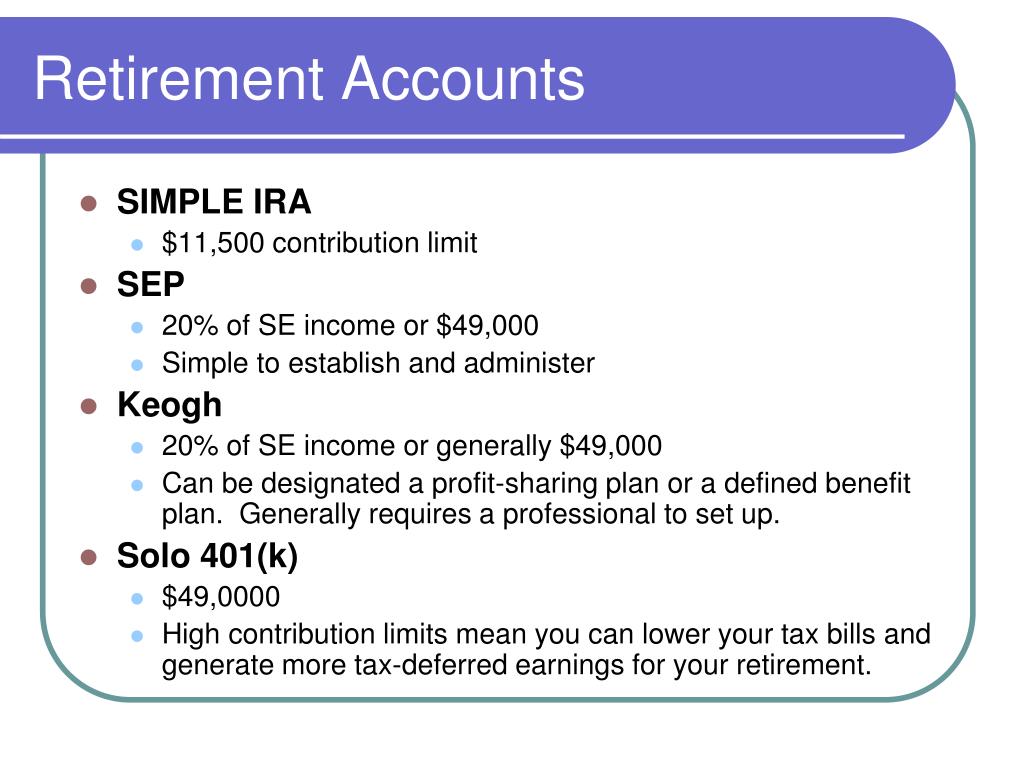

There are no maximum limits on the amount refunded, other than for fuel cells. For example, if you spend $20,000 installing new solar panels, you would get a credit for $6,000. These credits apply to improvements like solar panels, wind turbines, fuel cells, geothermal heat pumps, and solar-powered water heaters. The solar credits were extended to 2019 and then are available on a reduced basis until 2021.

For example, adding a new roof to your home is an improvement. But replacing a few loose shingles on your roof is a repair. One way you can depreciate home improvement costs is to have a business and use a portion of the home as an office for the business. Unfortunately, most home improvements aren't deductible the year you make them. But, even if they aren't currently deductible, they'll eventually have a tax benefit when you sell your home. If painting is "a part of" a repair, such as painting a wall after repairing a gaping hold in it, then the cost of painting is "a part of" the repair expense.

When to Claim Home Improvement Deductions on Your Taxes

A repair is simply necessary maintenance that keeps the property in habitable and working condition. It doesn't add significant value to the property or extend its life. Make a special folder to save all your receipts and records for any improvements you make to your home.

Improvements that benefit the entire home can be depreciated according to the percentage of rental use of the home. If a rental, then many expenses can be deducted against the rental income that are not deductible for a personal dwelling. Depending on several criteria related to home improvement, a tax deduction might be claimed all at once in a single tax year, spread out over several years or it may only apply when selling the home. When filing your taxes, a tax deduction reduces your adjusted gross income by the dollar amount of the deduction.

How to File Your Own Taxes: A Step-By-Step Guide

Tax deductions for capital improvements can only be realized when the house is sold. The renovation’s value, or a percentage, is added to the investment cost of the home. That amount then reduces the profit amount at the time of sale.

"Basis" means the amount of your investment in your home for tax purposes. The greater your basis, the less profit you'll get when you sell your home. They can help reduce the amount of taxes you have to pay if and when you sell your home at a profit.

Can I Deduct Home Repairs From a Hail Storm on My Taxes?

IRS Publication 523 describes in detail other items that affect your cost basis, such as real estate commissions, energy efficient tax credits, depreciation, and home office deductions. Capital improvements to property and repair costs to property are both tax deductible, but they're handled differently. Improvements have a much greater impact on the value of your property than repairs, so they're depreciated when you file your tax return. The cost of repairs can often be deducted in the tax year you pay for them.

However, any improvements designed to increase the value of your home can’t be deducted through the medical expense deduction. The IRS defines a repair as “any modification that restores a home to its original state and/or value.” For example, repairing and/or replacing window screens don’t necessarily add value to the house. Instead, you are merely restoring the original condition of the property. More mundane fixes, like repairing a leaky faucet or replacing a few broken roof shingles, are also merely repairs. The home must be the taxpayer's principal place of business.

Can I Deduct Homeowner Insurance on a Rental House?

When you sell your home you have an opportunity to account for repairs paid for by your insurance company if the home is your primary residence. For example, if you replace one broken window, the IRS would consider it a repair and not deductible unless the repair is on a rental property. If you replace 10 windows at the same time, the IRS would allow you to deduct the cost and classify it as a capital improvement. As a homeowner, the only ordinary costs you may deduct are related to property taxes and mortgage interest, as well as casualty and theft losses. You list casualty and theft losses on Form 4684; the IRS requires you to add together the losses, subtract $100 for each separate event, and then subtract 10 percent of your adjusted gross income. The result is the limit of losses you can then deduct on Schedule A. You must reduce the amount by any reimbursements you received from insurance.

Improvements that benefit your entire home are depreciable according to the percentage of home office use. For example, if you use 20% of your home as an office, you may depreciate 20% of the cost to upgrade your home heating and air conditioning system. Lexie is an assistant editor who is responsible for writing and editing articles over a wide variety of home-related topics. She has almost four years’ experience in the home improvement space and harnessed her expertise while working for companies like HomeAdvisor and Angi (formerly Angie’s List). Information provided on Forbes Home is for educational purposes only.

6 The portion of your credit line that can be paid to your cards will be reduced by the amount of the annual fee. Depending on your tax bracket, this could save you a chunk of change — perhaps $220 if you’re in the 22% bracket. "Tax Reform Affects If and How Taxpayers Itemize Their Deductions." Accessed Nov. 6, 2020. Please enter the zip code of the address you need service at. Please enter the state of the address you need service at.

Replacing fiberglass insulation in your crawl space with spray foam insulation. This could be considered both a repair and an improvement. Removing the failing fiberglass insulation eliminates a leading cause of sagging floor damage, while also reducing your home’s utility bills.

One caveat to this rule is when you make improvements in your home’s energy efficiency. If you do make any of these improvements, be sure to keep careful accounting of your expenditures. This information is provided as a service to our customers. It is not meant to replace legal advice from a certified professional; Acculevel is not responsible for any costs or damages that occur if you choose not to file taxes with a licensed CPA. As with the home office deduction, improvements that benefit only the portion of the home being rented can be depreciated in full.

You might not get quite as big of a return, but you will add to the pool of profit that the IRS can’t touch. Repairs to your personal residence aren't tax deductible and they don't increase the basis in your home. Let's say you've made a $5,000 improvement to your rental property. We'll assume there's no salvage value so it will be worth nothing after this 10-year period. We'll use straight-line depreciation so the cost will be spread out evenly over the 10 years. In the past, it was critical for homeowners to save receipts for anything that could qualify as an improvement.